Process to link Aadhaar card with PAN card

Income tax guidelines and rules.

As per Income Tax guidelines, as per CBDT’s circular no. 370142/14/22 tpl dated, the person who had linked PAN card till 1st July 2017, did not have to pay any fee, but those who linked PAN card after July 1st, 2017. After PAN card was not linked to Aadhaar card, those people had to link Aadhaar card with PAN card by 31 March 2022 by paying ₹ 500 to Income Tax Department,

But after July 2022, this fee has been increased from ₹ 500 to ₹ 1000, earlier its last date was 31 March 2023, but now it has been extended further, so if you have not linked your Aadhaar card with PAN card If you have done this, then link your PAN card with Aadhaar card as soon as possible, if you do not do this, you can also face a penalty of ₹ 10000, so avoid the penalty and link your Aadhaar card with PAN card now.

These people will not have to link PAN card with Aadhaar card.

- If you are an NRI, you do not need to link PAN card with Aadhaar.

- If you were a citizen of India earlier, and now you are not a citizen of India, then only you do not need to link PAN card with Aadhaar.

- If you are attaining 80 years of age by March 31, 2022, then only you do not need to link PAN card with Aadhaar.

- Even if you come from these particular states like Meghalaya, Jammu & Kashmir and Assam, you do not have to link Aadhaar card with PAN card.

How to link Pan with Aadhaar. It is very important to link aadhaar with Pan Card. If you don’t link it with your Aadhaar, your pan will be invalid, you may deprived from many Services . Pan Aadhaar linkage helps to track your financial records. It helps to track tax evasion. If you do not link your PAN card with Aadhaar card. then you will not be able to use the services provided.

- You can’t buy Gold more than 5 lakhs Rupees

- You will not be able to open any new bank account.

- You can’t withdraw or deposit more than 50000 rupees.

- You can’t file your ITR.

Last date to link Pan with Aadhaar was 31st March,2023 but now it has been extended upto 30th June,2023. To use all the services given above kindly link your aadhaar with pan card within given time period.

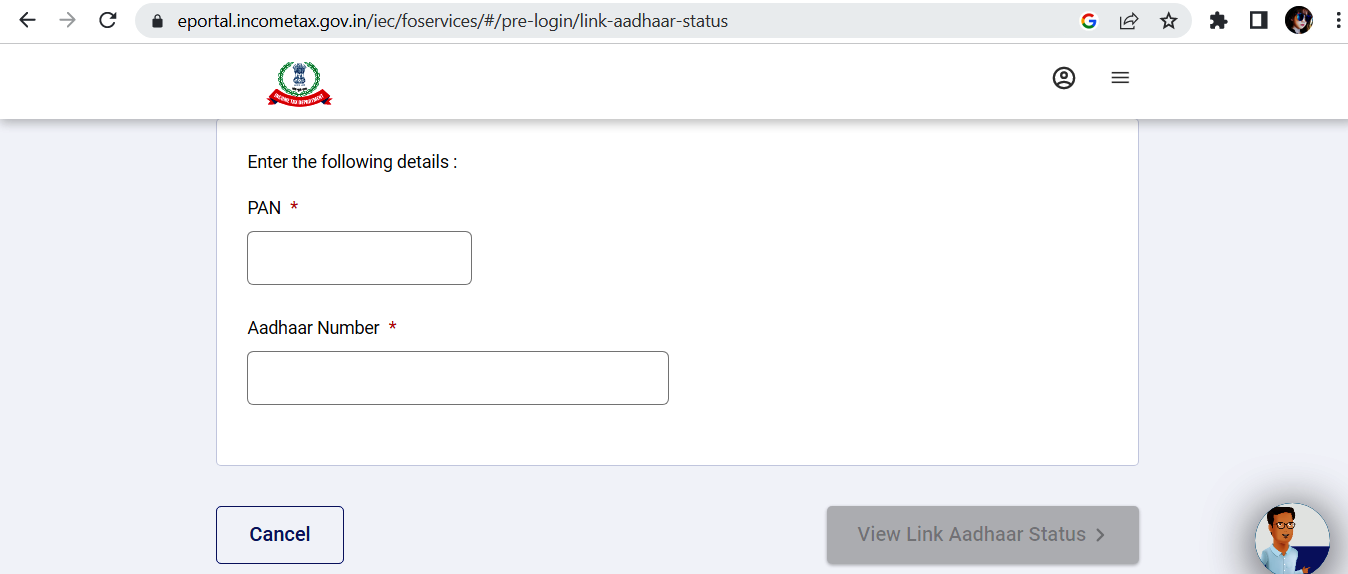

How to check whether Aadhaar card is linked with PAN card or not?

Visit to https://www.incometax.gov.in/iec/foportal/

Step 1. Click on Link Aadhaar to check status of Pan card Aadhaar linkage status.

Step-2. Fill your Pan card number and your 12 digit Aadhaar Number in the following boxes. Click on view link aadhar status.

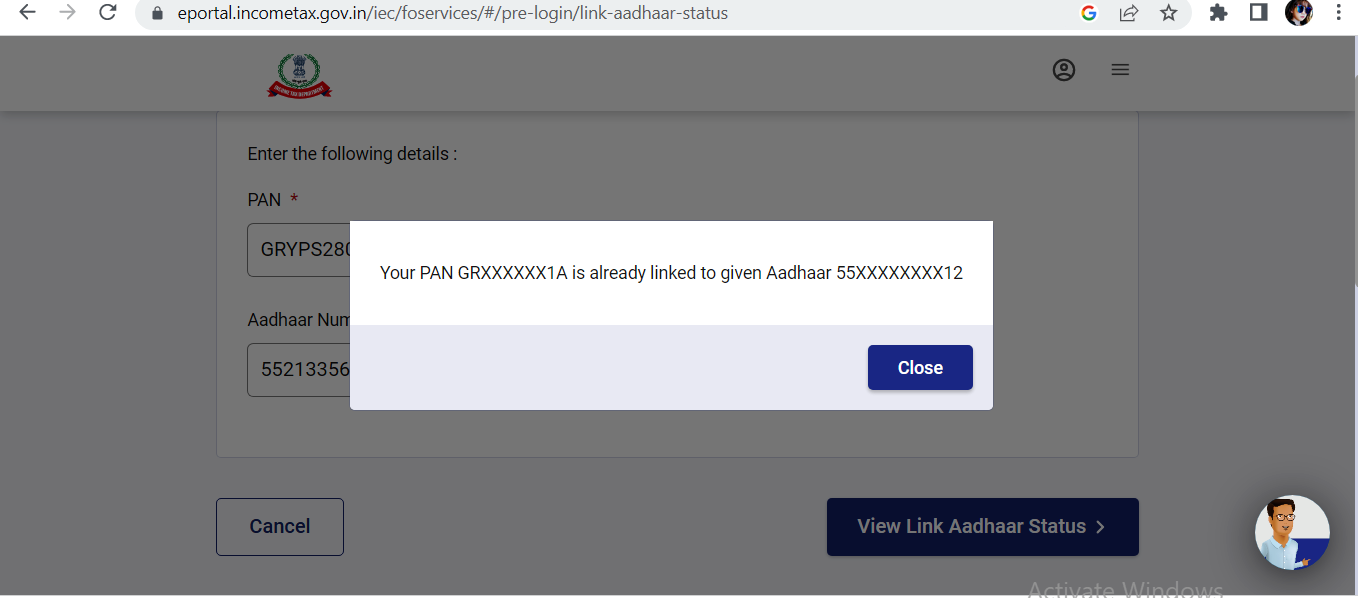

Step-3. If you Aadhaar is linked with Pan, You will find such message on screen “Your PAN XXXXXXXXX is already linked to given Aadhar XXXXXXXXXXXX. If your Aadhar is not linked you can follow the below process.

How to Link Pan card with Aadhaar – Online step by step.

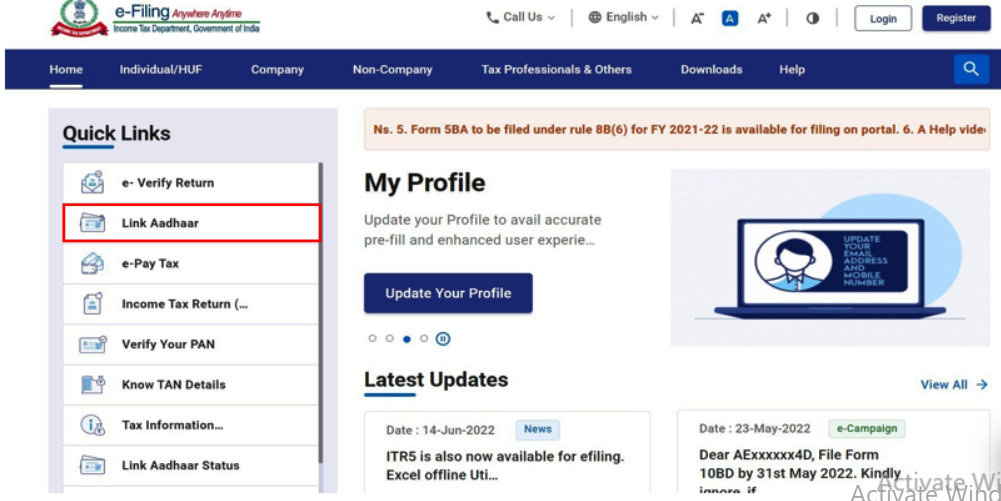

Procedure to link Aadhaar with Pan card step by step

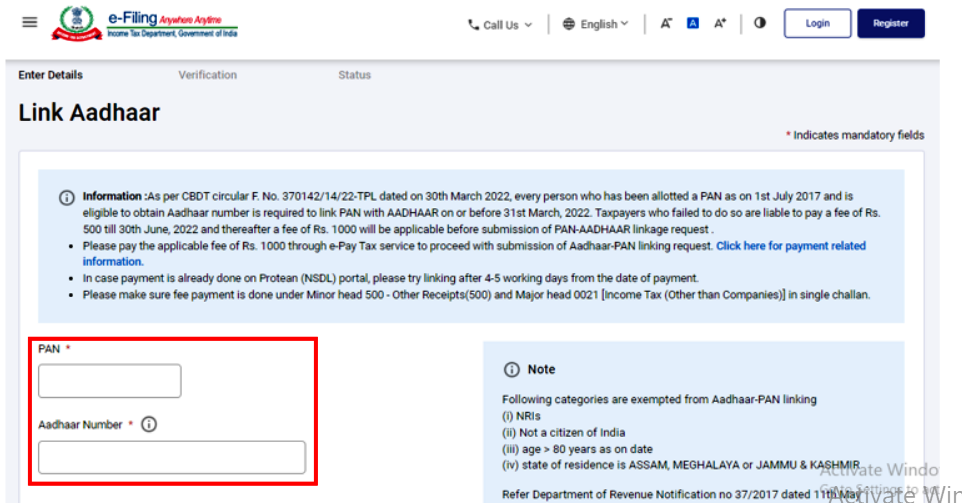

Step-1. Visit https://www.incometax.gov.in/iec/foportal/ income tax site. Find quick link section ‘Link Aadhaar’ in the left. Click on Link Aadhaar. Steps to link Aadhar with pan are given below.

Step-2. Enter your 12 digit Aadhar card number and Pan card number and submit.

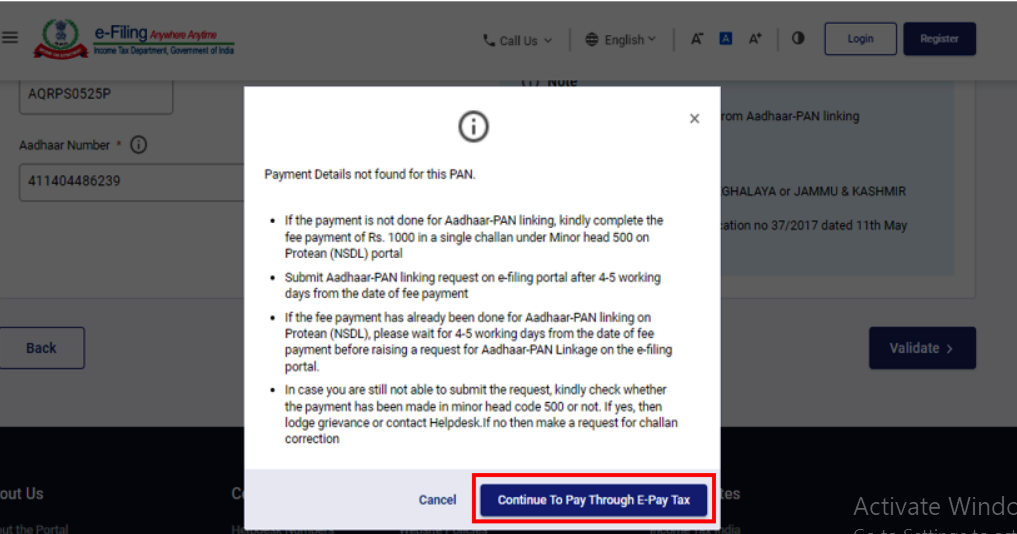

Step-3. Click “Continue to Pay through e-pay Tax” to complete the process of link aadhar.

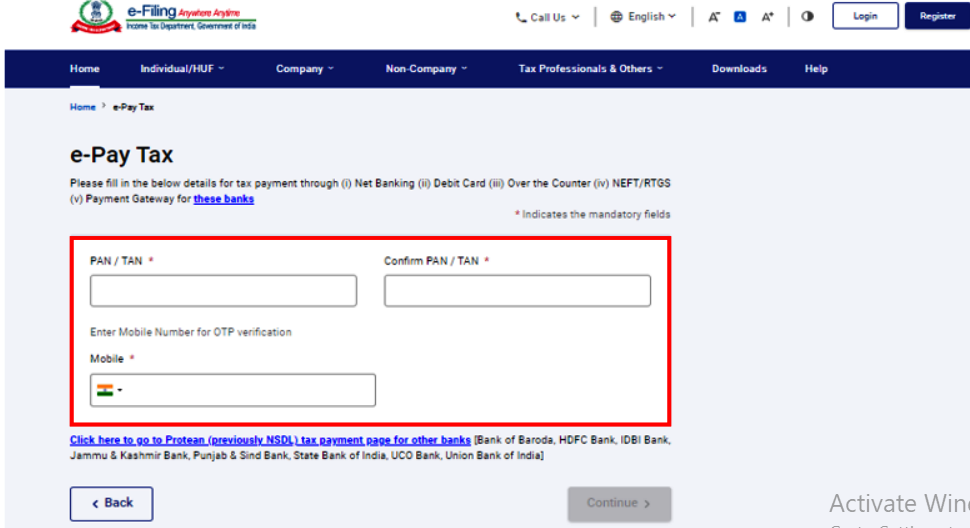

Step-4. Enter your Pan and confirm it, and type any mobile number to receive OTP and continue. Follow the procedure to pay the amount.

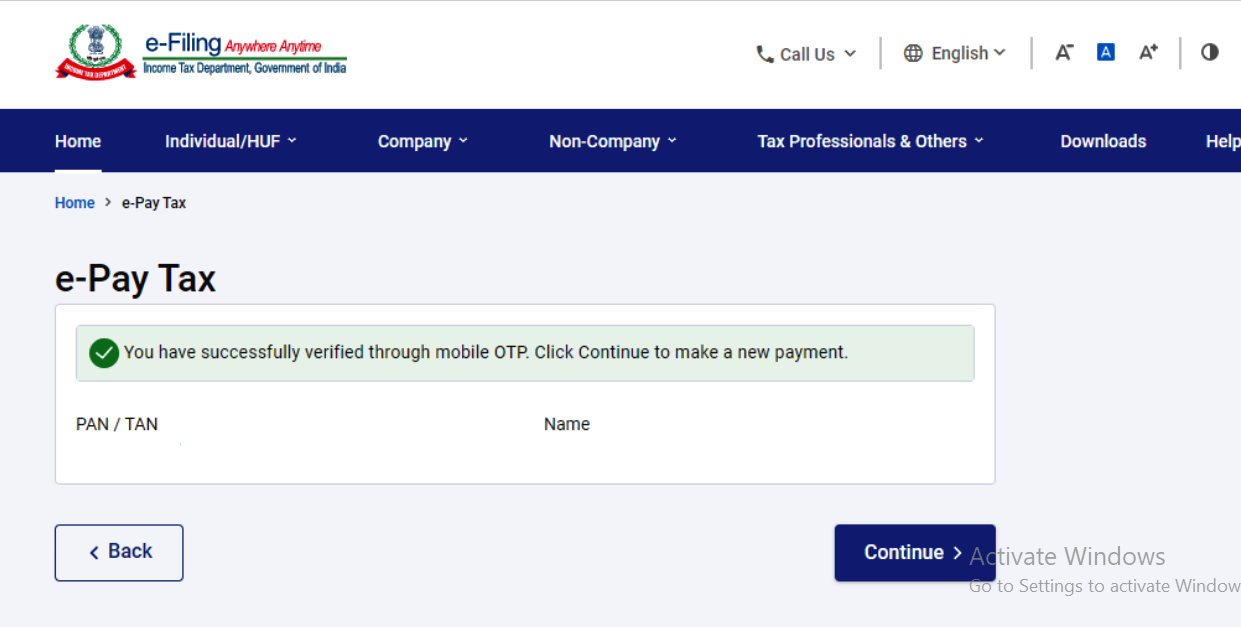

Step-5. Verify OTP and you will be redirected to given page. You will find this on ‘ You have successfully verified through mobile OTP. Click continue to make a new payment’. You will be redirected to the e-pay tax page.

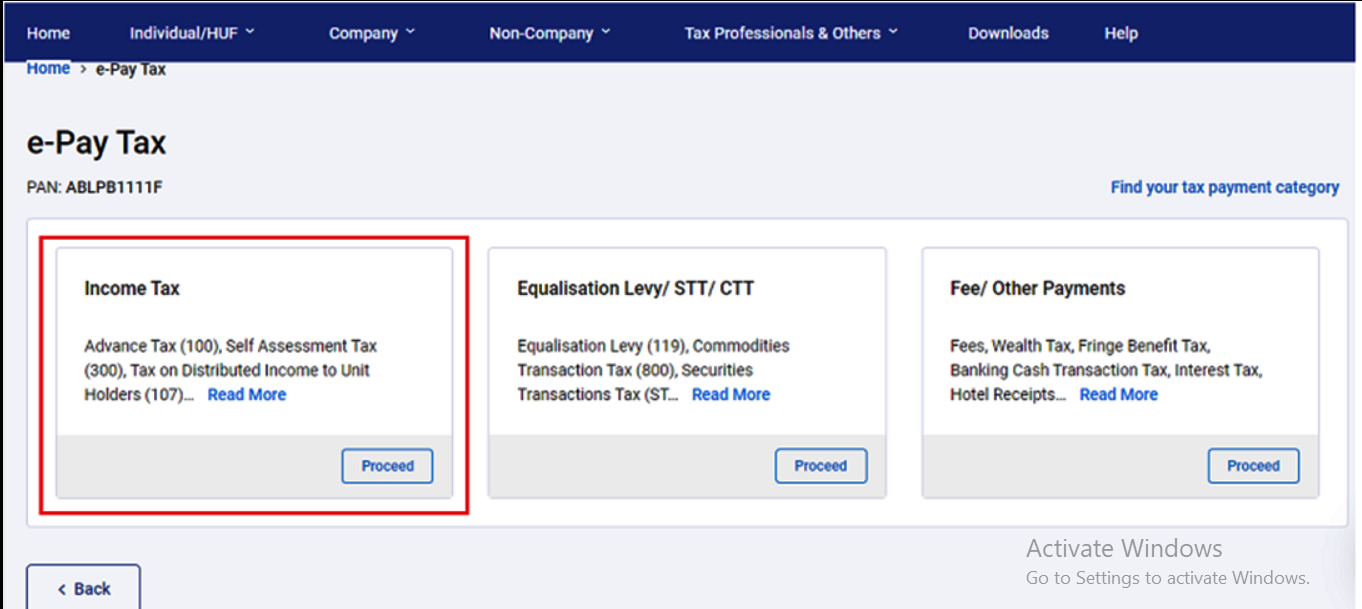

Step 6. Click on proceed in Income Tax box (Advance Tax(100), self Assesssment Tax(200), Tax on distributed income to unit Holders(107)…

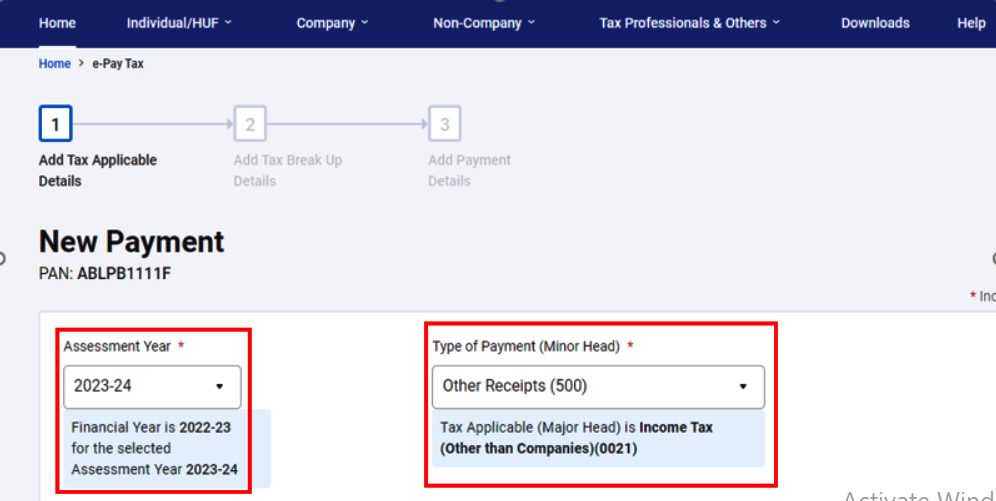

Step-7. Select 2023-24 as Assessment Year for financial year (2022-23) and Type of payment (minor Head) is Other receipts (500). Tax Applicable(Major Head) is income tax (other than Companies)(0021)

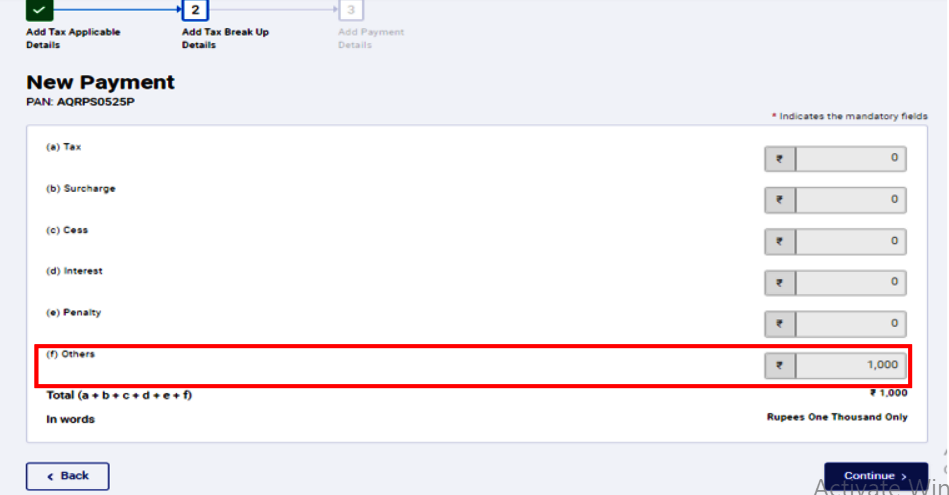

Step-8. Select (f) as Others 1000 rupees.

Step- 9. Now Challan will be generated. Select your payment type, on the next page. Do the payment and you will get a receipt after successful payment like this.

We hope you have got the right information, you must have been satisfied with this information, you can easily link your Aadhaar card with PAN card by following the steps given by us.

Thanks for visiting our site, please visit once for better information.

Excellent Process

Amazing strategy

vurcazkircazpatliycaz.QMD1G3ADGOac

driveler xyandanxvurulmus.CPCJMeJI0CJA