SBI Mudra Loan Application: If you want to open a new business, or want to expand your business and getting loan for this is getting difficult. SBI brought SBI Mudra Loan to solve your problem. To get this loan, you will neither have to bother with much paperwork nor need to go to the bank. You can apply for SBI Mudra Loan from the comfort of your home. By applying for this loan, you will easily get a loan of up to 50,000 in just 5 minutes.

Today, through this article, we would like to tell you how to apply for SBI Mudra Loan , along with the benefits of loan from SBI, documents required to take loan, eligibility and type of SBI Mudra Loan.

Benefits of taking Mudra Loan from State Bank of India

SBI Mudra (State Bank of India) loan is offered by Micro Units Development and Refinance Agency. Under this scheme, the small and medium businessmen of the country who already have a business or want to further their business, then you can apply for SBI Mudra loan, and start your business in a new way. Can On the other hand, those who want to start their new business can also take advantage of this scheme. Take a loan under this scheme and with this loan you can not only open a new business but also invest in your business so that their business can grow well.

By applying online in SBI Mudra Loan , you can get a loan of up to 50,000 for your business, for this you must have a savings account or current account in SBI, as well as you must have your business papers, only then you can apply for this loan. Can apply.

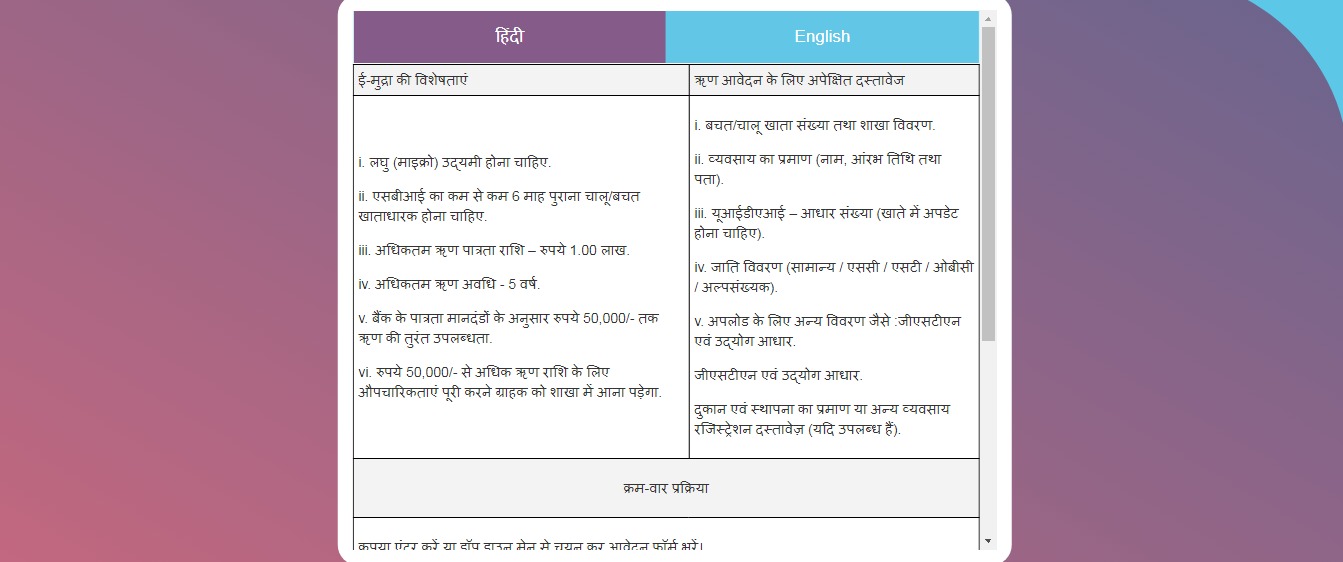

Documents required in the application for taking SBI Mudra loan

To take SBI Mudra loan, you must have all these documents like –

- Aadhar card .

- Bank Account (Saving/Current) details of savings / current account number.

- Udyog Aadhaar Number (UDYOG Aadhaar) and GSTN

- Your business documents.

- Address proof of business.

- UIDAI- Aadhaar number (must be updated with bank account).

- Caste Details (General / SC / ST / OBC / Minorities).

- Proof of shop and establishment and business registration.

- Note – You have to upload all the documents in PDF/JPEG/PNG format only, all documents have to be uploaded in maximum 2MB file size only.

- There are three types of loans offered in SBI Mudra Loan which are as follows. ,

- Shishu Loan – Under Shishu loan, you can take a loan of up to 50000.

- Kishor Loan – Under Kishor Loan, you can easily get a loan from ₹ 50000 to ₹ 500000.

- Tarun Loan – The day to day business of such people under Tarun Loan is very big and they can easily take loan from 500000 to 1000000 for investment.

District Industries Centre Loan Scheme Form 2023 Online

Highlights Key Points of SBI Mudra Loan

|

Beneficiary |

Small and Medium Business in India |

|

Pradhan Mantri Mudra Yojana launched |

2015 |

|

Types of SBI Mudra Loan |

3 Types of Mudra Loan (Shishu loan, Kishor loan, Tarun loan) |

|

SBI Mudra Loan Repayment Tenure for Loan for Business Purposes |

3 to 5 years |

| Official Website |

Eligibility Criteria – For SBI e-Mudra Loan

- The applicant must have a savings account with SBI or a current account of at least 6 months old.

- The maximum loan amount under this scheme should be up to ₹ 100000 only.

- Which you can repayment for 5 years.

- An instant loan of ₹ 50000 will be made available to you by the bank.

- If you want to take a loan of more than ₹ 50000, then you have to visit your nearest SBI bank branch.

- SBI Mudra loan will be given only for non-agriculture businesses.

- The person must be a loan defaulter to avail the loan.

- Individuals and any small business can apply for the loan.

- To take a loan, you must have business documents.

It is also important to note that only citizens in the age group of 18 to 60 years can take advantage of this scheme, under this they can take a loan up to 50000 by following some steps. This loan can be very beneficial for small and micro traders, as they are given a very long tenure of 3 to 5 years to repay this loan.

How to apply SBI Mudra Loan

To take SBI Mudra Loan, you have to follow the steps given below –

- First of all, the applicant has to visit the official website of State Bank of India’s e-mudra portal, whose link you will find below.

- As soon as the applicant visits this website , you will have to click on the option of proceed for e-mudra in the home page here and a new page will open in front of you.

- Now applicants can easily apply for SBI Mudra Loan through authenticated verification of Aadhaar card.

- All these processes have to be completed within 30 days from the date of receipt of SMS on your loan approval.

We hope that you have liked this information of ours, if you like this information, then you must share it with your friend, family and group. So that they too can get this information.

Thanks for visiting our site, please visit once for better information.